Dodeka II:Twelve Capital AG is pleased to announce the issuance of its second private Catastrophe (“Cat”) Bond “Dodeka II”.

Press Release

Swiss insurance investment manager Twelve Capital AG is pleased to announce the issuance of its second private Catastrophe (“Cat”) Bond “Dodeka II”.

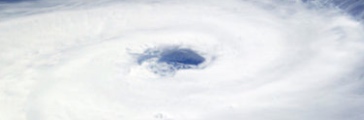

Dodeka II is an USD 25m zero-coupon Cat Bond that expires on December 15, 2014. It covers the risk of natural catastrophes in the US and can be triggered if certain insured industry loss levels associated with either one of the following two scenarios are reached.

Scenario 1

An earthquake during the first 3 months and at least one windstorm over the remaining 6.5 months of the life of the bond.

Scenario 2

At least two windstorms occurring during a period of 6.5 months before the bond’s maturity date. This structure is unique given it combines two different type of events corresponding to two specific time segments. It enriches the liquid cat bond space by adding alternative to the limited second event Cat Bond capacity.

Structuring private Cat Bonds has become an increasingly important focus of Twelve Capital’s work. These innovative instruments are extending the range of insurance investment opportunities that Twelve Capital already offers.

“We have a great network in the (re)insurance sector, and we have the in-house expertise to transfer insurance risk into liquid niche transactions of a manageable size,” says Dr. Roman Muraviev, Director at Twelve Capital.